It’s been over a year since the NEI Long Short Equity Fund was launched and we’re off to a great start!

Summary:

It’s been over a year since the NEI Long Short Equity Fund was launched and we’re thrilled with the performance thus far. The fund has delivered annualized performance of 18.37% since inception*. The fund was able to do this while taking on less market risk than the index, and other standard long-only equity funds.

Now, looking at the present and into the future, how is the current market environment set up for this long-short equity strategy? Lately we have seen significant volatility and uncertainty caused by political regimes and macro uncertainty. Investors need to expand their toolkit to utilize strategies that can help them navigate this new environment, seek enhanced returns, and protect against volatility. Long-short equity strategies are well-suited for this as they can supply additional sources of return by offering the flexibility to capitalize on both rising and falling stock prices, while diversifying a portfolio’s overall market risk. In short, volatility creates opportunities for long-short equity strategies.

Long-short equity capitalizes on seeking to create value by buying positive change, good value, and high-quality companies, while shorting the opposite—regardless of market conditions.

That’s the core thesis behind the NEI Long Short Equity Fund. The fund is provided by NEI Investments and sub-advised by Picton Mahoney Asset Management (“Picton Mahoney”), an expert in alternative asset management with two decades of experience managing long- short strategies. The result is a strategy designed to generate alpha from bifurcated markets with the goal of providing investors a smoother ride.

Upgrading the long-only portfolio

By offering the flexibility to capitalize on both rising and falling stock prices, long-short equity strategies can be a valuable component of a diversified investment strategy. This approach broadens the opportunity set for returns, provides diversification benefits, can mitigate downside risk, and can navigate through various market conditions more effectively.

Broadening opportunities for returns

Long-short strategies can enhance performance by going long and short by leveraging the broader opportunities available in the market. Unlike traditional long-only strategies that focus only on securities expected to outperform, long-short strategies aim to benefit not only from rising prices, but also from falling prices through short selling. This dual approach expands the opportunity set and taps into opportunities that long-only investments cannot access.

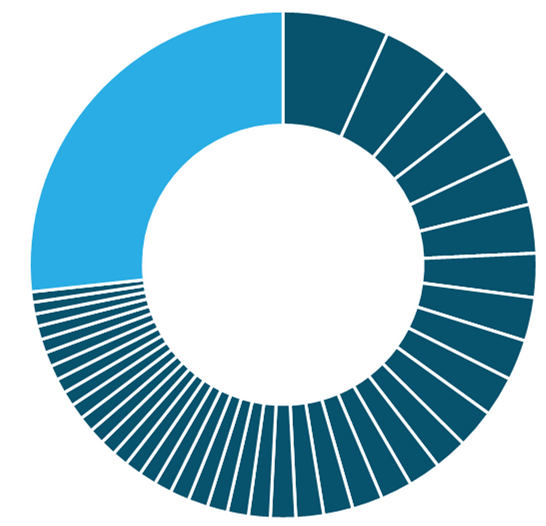

The S&P/TSX Composite Index is very top heavy (40 stocks make up over 70% of the Index)

Source: Picton Mahoney Asset Management. For illustrative purposes only.

The ability to short enables portfolio managers to express meaningful weights in the 200+ stocks in the S&P/TSX that most funds and ETF's cannot.

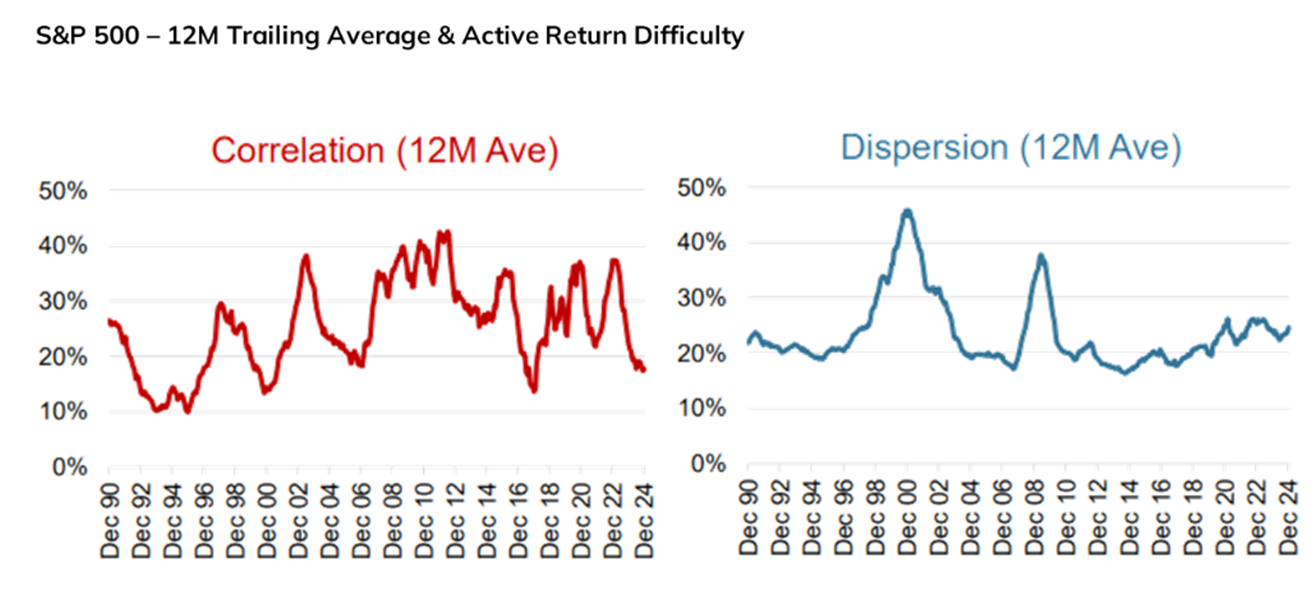

Security dispersion as an alternative source of returns

Security dispersion, the difference in returns between winners and losers in the market, can represent an alternative source of return often not captured in traditional 60/40 portfolios. The wider the dispersion of returns between the best and worst performers, the more abundant the opportunities for active long-short strategies to capitalize on. Long-short portfolios can be positioned to reflect expected return differences across the investment universe and exploit the spread in performance between long and short holdings in an environment where absolute market returns may be muted. Factors like increased volatility, persistent inflation, divergent central bank policies, and changing economic growth can increase dispersion, making long-short strategies particularly effective in such environments.

Beneath the Headline Index an improved environment for stock selection for Long Short Managers

Source: S&P Dow Jones Indices, December 31, 1990 to December 31, 2024. Index Dashboard: Dispersion, Volatility & Correlation.

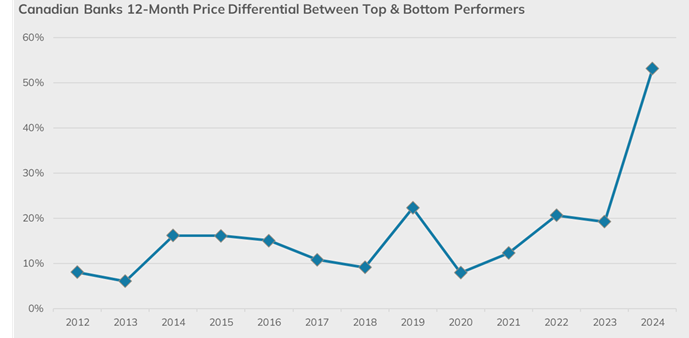

Diverging capital Allocation Over Time Has Led to Greater Price Performance Differential Between Canadian Banks

Source: Bloomberg, Picton Mahoney Asset Management Research, December 31, 2011 to December 31, 2024.

For more details on NEI Long Short Equity Fund, visit our Alternatives page.